The unleashing of COVID 19 on humanity has been an unprecedented catastrophe in recent times. Even if we go back in history, other pandemics would be a pale shadow to the present impact of this virus on the health and economies of all countries worldwide. This scourge has affected all of humanity, impacting lifestyles, businesses, economies and our common we being.

Even before the onset of this pandemic, the global economy was facing turbulence on account of disruptions in trade flow and growth. The present situation has now been escalated by the demand, supply and liquidity shocks which the COVID 19 has inflicted upon the entire industry. Once the pandemic is managed, the shape and speed of recovery of our economy will be the key factor for the further growth of the country.

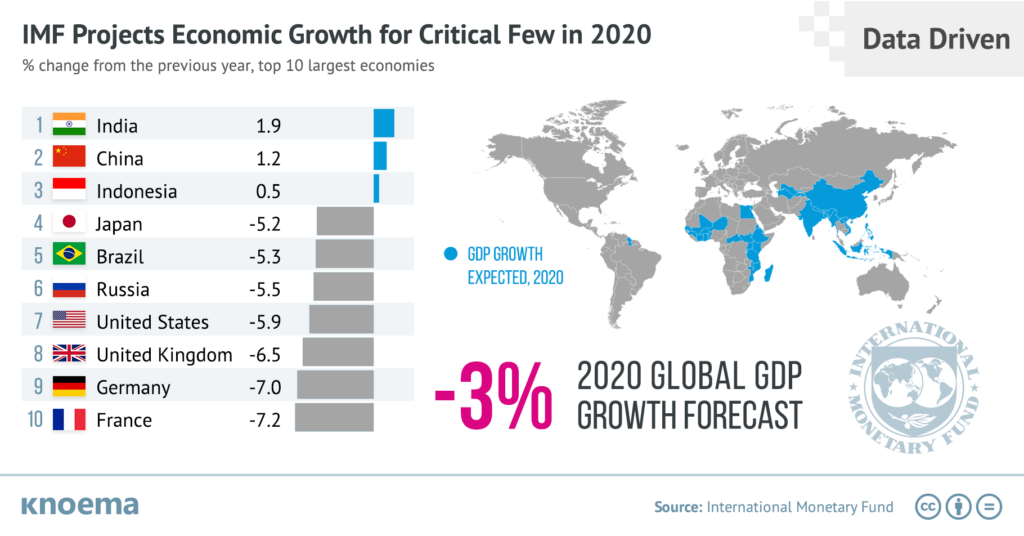

It is our expectation that the course of economic recovery in India would be much smoother and faster than the advanced countries. The UNCTAD in its latest report “The COVID 19 shock to developing countries”, has predicted that major economies least exposed to recession would be China and India. While we are focussing now on India to protect our people from health hazards and providing relief to the poor and needy, we also need to formulate a strategy on how to secure the health of our economy, resuscitation of businesses and maintain livelihood for our people. There will be a requirement to create a safe environment to work, ensuring job continuity and job creation.

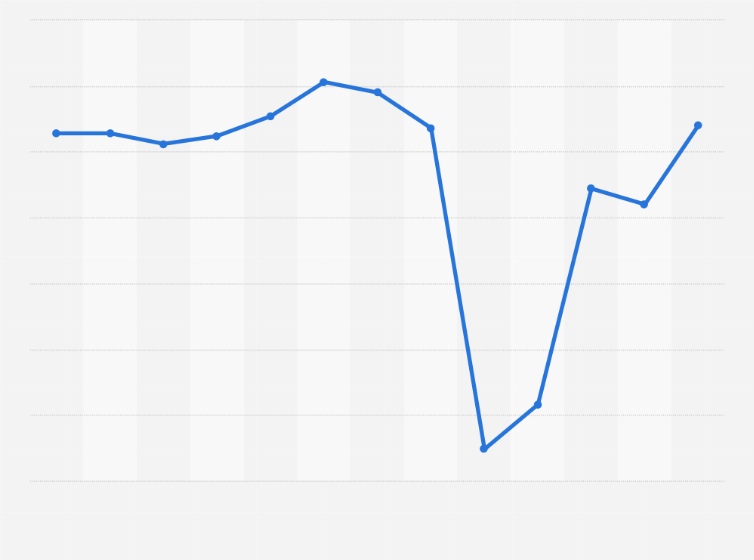

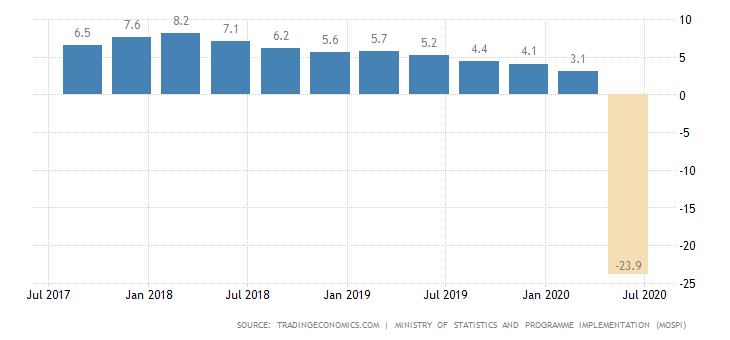

It is therefore imperative that we focus our thoughts for some time to discuss the world economy post-COVID 19. A comparison of GDP the world over a period of last three years would suggest an appreciable downslide. Since the economy was already on the downslide, the situation now has further got accentuated as nations have shut down their economic activity which has seriously impacted manufacturing supply chains and has sharply curtailed energy and commodity demand. What was previously a manufacturing only recession has spread to the services sector also. A look at the Purchasing Managers Index (PMI), shows recessionary conditions as all countries are below index level of 50 including the USA, Japan and China.

The impact on the Indian economy has been immense. India’s real-time GDP decelerated to its lowest in six months to minus 23.9%%. It’s core sector contracted by 6.5% in March 2020. The lockdown had brought economic activity to a standstill and seriously impacted consumption and investment. While Indian businesses barring a few can possibly insulate themselves from the global supply chain disruption caused by this outbreak due to lower reliance on intermediate imports, their exports have taken a hit. In the overall analysis, the three major contributors of GDP- Private Consumption, Investment and External trade could take a serious hit.

Let us now do a scenario building exercise to explain the effect of COVID 19, which would lead us to strategy building. I am reminded of the famous quote of Sun Tzu here, which says “However desperate the situation and circumstances, don’t despair. When there is everything to fear, be unafraid. When surrounded by dangers, fear none of them. When without resources, depend on resourcefulness. When surprised, take the enemy by surprise”.

Three possible scenarios can emerge under the present circumstances:-

# The virus starts receding all across and things normalise by end December 2020. In this situation, India growth starts on the road to recovery and GDP could grow up to 4%.

# While India is able to contain the virus, other countries still remain affected. In this case, our GDP would be expected to grow in the region of 3%.

# The virus does not get contained in India as well as the rest of the World. In this scenario which probably is the worst case, our GDP growth would move to a further negative figure.

Our strategy, therefore, would need to be formulated to tackle the worst-case scenario, which would be akin to living with the virus. As is widely believed, I quote, “If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

To come upon evolving a plausible strategy, it would be necessary to analyse sector-wise, the impact of COVID 19 on our economy. The abrupt stop to urban activity has led to a steep fall in the consumption of non-essential goods. The situation can further get aggravated in the coming months if the domestic supply chain further gets disrupted by a non-stimulating economic policy and starts affecting the availability of essential commodities. A look at demand-side impact statistical data indicates that major private consumption areas relate to food/beverages (26.3%), housing/water/electricity (13.7%), transport (17.7%), clothing and footwear (5.8%) and health and education (8.5%). Another area of impact is the informal sector. Around 37% of regular wage/salaried employees in urban India are the informal workers (non-agricultural), who will face uncertain income. (Source: KPMG report on the potential impact of COVID 19 on the Indian Economy).

This severe impact on demand caused by the pandemic has created large cash flows gaps by corporate. Tight financial conditions will make it difficult for them to fill the gap in market borrowings. Some of the sectors which will get largely impacted will be as under:-

# Apparel and Textiles– These constitute 2% of our GDP. Low demand will hurt the sector. A decline in sales of about 10-12% is visualised. Govt will have to get in to reduce the interest rate on loans as well as tax compliance deadlines.

# Auto and Auto Components– These constitute 9.4% of our GDP. During this lockdown, the auto sector incurred losses at the rate of Rs 2300 crores/day. There has been a loss of 28K Crores of GST. This industry accounts for a total of 15% of the GST collections. Low demand will hurt the sector. Cash flow will be reduced. The demand for commercial vehicles will be reduced. The new launches will also get delayed. Govt will have to get in to reduce GST rates as well as interest on loans.

# Aviation and Tourism– These constitute 11.6% towards our GDP. Low demand will hurt the sector. Travel is likely to shrink by more than 25%. Govt will have to get in to resort to a GST holiday for at least 12 months as well as VAT on ATF would need to be rationalised.

# Building and Construction– These constitute 13% towards our GDP. The growth of infrastructure this year has been 0.6% as compared to 4.4% last year. There will be a muted demand. Free equity investment in this sector will slow down. The retail sector will get affected. Govt will have to get in to resort to a GST holiday for at least 12 months and carry out relaxation in project delays (RERA).

# Consumer/Retail/Internet– These constitute 10% towards our GDP. The supply chain will have the maximum impact on this sector. There will be a growth for essential commodities whereas non-essential commodity demands will face a downward spiral. Govt will have to come out with GST waivers and cut import duties. It will be a great challenge to embrace the ‘New Normal’. The business landscapes are bound to shift and our strategy for rejuvenating business and industries would need to be formulated on the following lines.

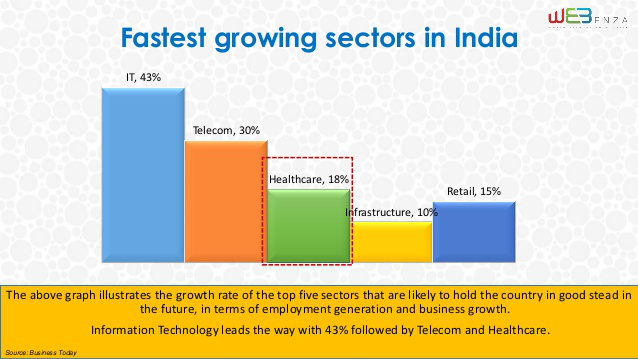

$ Surge towards Digitalisation– There would be a real opportunity to drive efficiencies through digital media. Investment in enabling technologies such as cloud, data and cybersecurity will increase. This will have far-reaching implications on B2B, B2C, B2G services, commercial real estate sector, e-commerce, e-governance, process automation, data analytics and self-service capabilities

$ Development of Cost-Effective Models- Endeavour will be towards reducing overall business costs. Emphasis on fixed costs will shift towards variable costs. There would be more focus on our sourcing.

$ Agility Building– Agility building will have to be adopted to take quick decisions in the absence of perfect data. Policies will need to be evolved faster, SOPs created. Situational leadership will come into play.

Taking the above factors into consideration, the revival strategy post lockdown will have to formulate as Recover-Rebuild-Rethink-Accelerate (RRRA) on the following lines.

- Recovering Revenue

- Rebuilding Operations

- Rethinking the Organisation

- Accelerating Adoption of Digital Solutions

The followings opportunities will present itself post the lockdown:-

The revival of the Pharma Industry– China today is facing quality and trust issues. China controls 55% of Active Pharma Ingredient (API). Govt need to infuse Rs 10000 crores for active pharma ingredients-bulk drug packs and revive old pharma units. They must build on production capacities of 58 APIs on which India is dependent on China.

Encourage Entrepreneurship. This lockdown presents an opportunity to micro-entrepreneurs, freelancers and independent run businesses. Financial technology platforms such as Instamojo, Razorpay will be much in demand as they help small businesses to establish online shops and facilitate payments. As can be seen, Instamojo has added a new merchant every one minute in the past one month. It has already done 25% of its average yearly revenue in this period.

Demand for Skilled manpower. Considering the maximisation of digital platforms, there is going to be a heavy demand for graphic designers, programmers and content writers. Freelancers will earn up to Rs 2 lacs/month which no permanent job will offer to them. LinkedIn and Dribble will become platforms to showcase your talents for hire. The gig economy is here to stay. Institutions will now hire people for specific micro projects/per task.

Logistics/Supply Chain Management. The growing e-commerce demand is likely to push the demand for warehousing and logistics spaces. The industrial and warehouse segment is going to bounce back the strongest. There will be a requirement for vacant retail spaces and warehousing. The weakest point in the supply chain will determine success.

Hospitality Industry. All loss-making ventures will have to be closed down. Cost-cutting and optimisation would be the guru mantra.

Agriculture Input Sector. With the announcement of normal monsoons, it would be expected that the agricultural input sector would get a boost with robust fertiliser sales.

Retail Sector. The quasi corporate model in agriculture must be thought of on the basis of the Reliance retail model. The essence is that we must grow what can be grown and not cater for preferences of a particular region to grow crops.

Online Coaching/Teaching. A wonderful opportunity presents itself for online coaching/teaching. Digital platforms like Zoom have already become hugely popular and will continue to do so.

Alternate Energy. There will be a great encouragement to pursue projects which harness solar and wind energy.

Data Sciences. Aspects such as artificial intelligence, machine learning, 10T will need to be adopted in the coming times.

Insurance. The insurance sector is likely to get a boost.

Government intervention will be required in the following areas:-

Supply Chain Management– Individual companies will ensure their supply chains are more resilient and competitive. It is important to note that if anyone link in the supply chain is disturbed, the entire supply chain gets stalled. For example in the case for the manufacture of gears; automotive production of mesh parts takes place in Pune, sub-assemblies are made in Hosur and the final assembling is done at Manesar. If any one activity is shut down at any one place, the entire supply chain gets stalled. Therefore every supply chain model will have to have a contingency plan inbuilt. Resilient capabilities will be developed in order to respond to uncertainties. Warehouses will relocate closer to customers. Therefore, the Govt needs to ensure seamless supply chain management across state boundaries. Also, the public transport system is required to be strengthened.

Lower Corporate Taxes– Lower Corporate taxes on selected items. Bangladesh has announced a corporate tax holiday on APIs.

Reforms in Aviation/Power/Labour/Mines/Coal Sectors– Govt would need to get its act together to all central and state Govt clearances are given in a time-bound manner. Plug and play infrastructure would be the need of the hour. First-mile connectivity for transportation of coal to be ensured right from coal transport to rail wagons. Tariff rationalisation in the power sector and timely release of subsidies would be paramount. Air space would need to be rationalised to reduce flying time in coordination with the Department of Military Affairs.

Export Enhancement – The Govt would need to target large exports to Germany, USA, Japan etc on single-window clearances.

Foreign Direct Investment– A methodology to be evolved and incentives are given to get maximum industries from China to re-locate in India. Also, there would be a need to step up investment in the existing 68 fortune 100 companies already based in India.

Globally, the future doesn’t seem to be very bright. IMF estimates for the year 2020 project overall negative GDP growth. In the coming weeks, the impact on how we live, how we work, how we use technology will emerge more clearly. Institutions that reinvent themselves using insight and foresight will succeed. Online contactless commerce will reshape consumer behaviour. The small and medium industries are the backbone of our economy and should be brought on a rail. The world has now changed over. Adaptation will be the key. The silver lining is that the fear of death has brought all communities together. Let us all take up this challenge. “Hum Honge Kamyaab”.

Title Image Courtesy:https://dailytimes.ng/

Disclaimer: The views and opinions expressed by the author do not necessarily reflect the views of the Government of India and Defence Research and Studies