This study examines the evolving role of private sector participation in the indigenous development and manufacturing of long-endurance Unmanned Aerial Vehicles (Military UAVs) in India. Against the backdrop of growing strategic and surveillance needs, this study highlights the persistent reliance on imported subsystems, regulatory barriers, and technological bottlenecks. Using secondary data from government sources, think tank publications, and defence industry reports, the paper analyses India’s policy landscape—particularly DAP 2020, iDEX, and the Strategic Partnership Model. It argues for deeper public–private collaboration, investment in propulsion and AI technologies, and the institutional adoption of an Open Modular System Architecture (OMSA) to achieve UAV self-reliance and export competitiveness.

Introduction

Long-Endurance Unmanned Aerial Vehicles (UAVs) constitute a specialised class of aerial platforms engineered for sustained operations—remaining airborne for durations ranging from several hours to multiple days with typical operational ceilings exceeding 10,000 metres. For instance, the MQ-9 Reaper (General Atomics, n.d) achieves over 27 hours of endurance, while India’s DRDO-developed TAPAS-BH-201 has demonstrated up to 18 hours of flight time, though it fell short of intended specifications. Prioritising persistence over speed or manoeuvrability, these systems have evolved from early 20th-century military reconnaissance tools to modern strategic assets exemplified by platforms like the MQ-9 Reaper (General Atomics, n.d) and India’s TAPAS-BH-201(Rkbhonsle,2025).

Strategically, long-endurance UAVs offer continuous situational awareness and reduce human risk, providing cost-effective alternatives to manned platforms. These systems are increasingly integral to both ISR and precision strike capabilities. Their payload flexibility enables them to carry electro-optical/infrared sensors, ELINT, COMINT, and Synthetic Aperture Radar, along with precision-guided munitions. Their utility has expanded to include border surveillance, disaster relief, environmental monitoring, and communication support. This diversification is enabled by advancements in aerodynamic design, lightweight composite structures, AI-driven flight management, and exploratory use of solar and hybrid propulsion technologies.

Globally, UAVs such as the U.S. MQ-1 Predator and MQ-9 Reaper (Gertler,2012) (General Atomics, n.d) have played pivotal roles in Afghanistan, Iraq, and Syria, including targeted strikes on high-value terrorist figures. The RQ-4 Global Hawk has been employed for persistent surveillance in conflict zones like Libya and the South China Sea. Israel’s Heron and Hermes UAVs have aided ISR and artillery targeting in Gaza and Lebanon, while Turkey’s Bayraktar TB2 has been widely recognised for its dual ISR and strike functions during the Ukraine-Russia conflict (European Council on Foreign Relations,2025). Similarly, China’s Wing Loong series has seen operational use in the Middle East (RAND Corporation,2014).

India’s growing reliance on long-endurance UAVs underscores their importance in multi-domain warfare. This creates critical openings for private sector participation. Enhanced private engagement can accelerate technology development, reduce strategic vulnerabilities, and enable India to meet both domestic requirements and export potential under the “Atmanirbhar Bharat” initiative. The convergence of operational necessity, technological maturity, and policy incentives highlights the strategic importance of fostering a robust domestic ecosystem. Private firms, leveraging design innovation, modular architectures, and manufacturing expertise, are well-positioned to complement public-sector efforts in developing next-generation long-endurance UAVs.

Review of Literature

The Evolution of Long-Endurance Unmanned Aerial Vehicles (UAVs) in India

The evolution of long-endurance Unmanned Aerial Vehicles (UAVs) in India reflects the broader national trajectory toward technological indigenisation in aerospace and defence. Initially dominated by public sector institutions—particularly the Defence Research and Development Organisation (DRDO) and its Aeronautical Development Establishment (ADE)—India’s UAV development has increasingly welcomed private sector involvement, catalysed by enabling policy frameworks and strategic imperatives. (George, S, 2025)

India’s early UAV efforts focused on tactical systems such as the Nishant (reconnaissance) and Lakshya (target drone), which, while significant, lacked the endurance required for sustained ISR missions.(DRDO,2025) The shift toward long-endurance platforms began in the 2000s with the Rustom series (Airforce Technology, n.d), led by ADE in collaboration with Hindustan Aeronautics Limited (HAL) and Bharat Electronics Limited (BEL). Rustom-I’s 2009 maiden flight marked a key proof of concept, paving the way for Rustom-II, later rebranded as TAPAS-BH-201(Post,2022; Rkbhonsle,2025).

TAPAS, formally initiated around 2011, aimed to meet Medium Altitude Long Endurance (MALE) requirements—24-hour endurance, 30,000 feet altitude, and 350 kg payload capacity. Its first flight in 2016 marked a technological leap, though the project faced delays due to propulsion inefficiencies, excessive platform weight (~2,850 kg), and reliance on imported subsystems. Nevertheless, TAPAS remains a pivotal milestone in India’s indigenous UAV capabilities. (GP Capt. Narang,2019)

Policy reforms post-2016 significantly expanded private sector opportunities in defence manufacturing. The Defence Procurement Procedure (DPP) 2016 and Defence Acquisition Procedure (DAP) 2020 introduced categories like Buy (Indian–IDDM) and Make-II to promote indigenous R&D and production. The Strategic Partnership (SP) Model enabled private firms to co-develop complex systems with foreign OEMs, including UAVs. Further, the Ministry of Defence’s offset policy requires foreign vendors to invest a share of contract value back into India’s defence ecosystem—via joint ventures, technology transfers, or local sourcing—boosting domestic UAV design and production.

Private firms have responded with increasing capability and innovation. Companies such as IdeaForge (Express Defence,2024), NewSpace Research & Technologies, Adani Defence (Bharadwaj, 2024) & Aerospace, and Tata Advanced Systems Limited (TASL) (IDRW,2025) have emerged as major contributors. NewSpace, under the Development-cum-Production Partner (DcPP) model with DRDO, is advancing MALE-class and swarm UAV technologies. TASL’s (IDRW,2025) collaboration with Israel Aerospace Industries (IAI) for Heron TP-class drones under SP and offset arrangements exemplifies successful public-private and international synergy.

Public institutions, notably DRDO, have provided foundational research and high-risk prototyping but often encounter execution delays. In contrast, the private sector brings agility, dual-use innovation, and export-oriented manufacturing but continues to depend on public support for key subsystems and faces regulatory and technology-access challenges.

The trajectory of long-endurance UAV development in India signals a maturing, hybrid defence-industrial ecosystem. The convergence of state-led R&D and private sector dynamism, reinforced by targeted policy support, is essential for achieving strategic autonomy and building globally competitive UAV capabilities.

Necessity of Private Sector Participation

India’s twenty-first-century defence preparedness increasingly depends on technological self-reliance in aerospace systems—particularly long-endurance Unmanned Aerial Vehicles (UAVs). Given the country’s extensive border regions and the growing role of unmanned systems in modern warfare, the indigenisation of long-endurance UAV design and production has become a strategic necessity. In this context, private sector participation is emerging as a transformative driver of indigenous capability enhancement and defence-industrial autonomy.

The geopolitical environment surrounding India, characterised by heightened tensions along the Line of Actual Control (LAC) with China and the Line of Control (LoC) with Pakistan, necessitates round-the-clock situational awareness and ISR capabilities. Long-endurance UAVs provide a cost-effective and operationally safe solution for maintaining a persistent aerial presence in contested zones. Moreover, the increasing prevalence of drone warfare, as evidenced in conflicts such as the Russia–Ukraine and Armenia–Azerbaijan wars, has underscored the efficacy of unmanned systems in both conventional and hybrid combat environments.

India’s private sector has emerged as a significant stakeholder in the development and production of Medium-Altitude Long-Endurance (MALE) and High-Altitude Long-Endurance

(HALE) unmanned aerial vehicles (UAVs). Leading firms such as Adani Defence (Bharadwaj, 2024) and Aerospace, in collaboration with Israel’s Elbit Systems, have established facilities for producing MALE-class platforms like the Hermes 900 and the domestically adapted Drishti-10 Starliner. Similarly, Tata Advanced Systems is contributing to loitering munition systems and ISR platforms through joint ventures with international partners.

Indigenous firms such as ideaForge have secured major contracts from the Indian Army for tactical UAVs like SWITCH, while NewSpace Research and Technologies is developing swarm drone capabilities and high-altitude pseudo-satellite UAVs. Other prominent actors include Paras Aerospace, Asteria Aerospace, and Throttle Aerospace Systems, each specializing in ISR, logistics, or AI-integrated drone technologies. Additionally, Economic Explosives Ltd’s development of the loitering munition Nagastra-1 demonstrates private capability in strike-capable drone systems.

Research Gap

Despite policy efforts promoting defence indigenisation, India lacks a structured framework to integrate private innovation into long-endurance UAV development. Fragmented public–private collaboration, insufficient modular standards, and continued reliance on foreign subsystems hinder strategic autonomy in unmanned aerial systems manufacturing.

Existing Problem

India’s increasing strategic and surveillance needs, combined with the evolution of aerial warfare, have highlighted the importance of indigenous long-endurance UAVs (Unmanned Aerial Vehicles). However, despite government efforts toward indigenisation and the promotion of self-reliant defence manufacturing, the development of advanced UAV platforms remains limited. A significant gap exists in fully integrating private sector innovation, capital, and technical expertise into the mainstream defence production ecosystem. The lack of structured public-private synergy, technological bottlenecks, and regulatory challenges further hinder India’s ability to meet its long-endurance UAV requirements domestically. This research investigates the necessity, scope, and strategic potential of private sector participation in building a self-sufficient indigenous UAV manufacturing ecosystem in India.

Research Question

How can private sector participation be effectively leveraged to accelerate the indigenous development and manufacturing of long-endurance UAVs in India, and what policy, technological, and strategic frameworks are needed to support this transformation?

Research Methodology

This research is based on secondary data collection, employing both qualitative and quantitative methodologies to ensure a comprehensive understanding of the subject. Data has been sourced from official government websites such as the Ministry of Defence (MoD), Department of Defence (DoD), and Press Information Bureau (PIB), which provide credible and up-to-date information. Additionally, insights have been drawn from research outputs and publications of reputed think tanks, including the Centre for Air Power Studies (CAPS) and the Observer Research Foundation (ORF), as well as relevant web-based articles. This multi-source approach ensures analytical depth and contextual accuracy in the study.

Analysis

Strategic Dependence on Imported Chinese Components

India’s UAV ambitions face critical challenges due to significant dependence on imported subsystems, especially from China. As per a parliamentary report, around 39% of flight controllers—crucial for UAV navigation and stability—are sourced from Chinese firms. Additionally, Indian manufacturers rely on China and Taiwan for electric motors, imaging sensors, battery systems, and rare earth magnets essential for propulsion and control. Between March 2022 and February 2023, UAV-related imports from China rose to USD 50–70 million, marking a 53% increase from the previous year. This growing reliance exposes India to vulnerabilities, particularly amid worsening geopolitical tensions (Raghav Sharma,2025).

Impact of Chinese Export Restrictions

China’s 2023 export restrictions on critical UAV components—including long-range controllers and advanced flight systems—now mandate special licenses, causing delays of up to two months. Simultaneously, rare earth elements like neodymium and dysprosium have seen price surges of nearly 50%, escalating motor costs and impeding procurement. These developments underscore China’s strategy to safeguard dual-use technologies and retain dominance over UAV and mineral supply chains, thereby intensifying India’s strategic and operational risks (N Chandra, 2024). (H Digital,2025).

Technological and Design Limitations

The discontinuation of the TAPAS-BH 201 programme in 2024 reflects persistent difficulties in achieving desired endurance and altitude benchmarks for long-endurance UAVs. Aerodynamic enhancements—such as high-aspect-ratio wings, winglets, and composite structures—are essential for endurance, but propulsion systems remain a major bottleneck. While solar-electric integration is mentioned as a solution, its viability is currently restricted to experimental high-altitude platforms like Airbus Zephyr, leaving mainstream MALE/HALE UAVs dependent on conventional fuel-based systems. (Jha, 2024) (Narang, 2017)

Compliance and Supply Chain Challenges

Compliance with global standards is particularly burdensome for MSMEs and start-ups due to limited access to certified testing facilities, qualified auditors, and technical mentoring. The requirement to eliminate Chinese-origin components, due to national security concerns, further complicates already import-dependent supply chains and production workflows.

Talent and Academic Gaps

Although institutions like IITs and NITs provide a strong engineering foundation, there is a marked deficit in domain-specific expertise essential for UAV development. Skills in advanced aerodynamics, AI-driven autonomy, turboprop engine design, and high-altitude navigation remain underrepresented in current academic programs. Brain drain further limits the domestic talent pool, as skilled professionals often migrate to better-equipped global R&D environments. (IIT Madras, 2023) (Goel, 2018)

R&D, Policy and Infrastructure Constraints

Despite initiatives like iDEX, the SP Model, and the Positive Indigenisation Lists, private sector engagement is hindered by bureaucratic inefficiencies, procurement uncertainties, and limited order volumes. India’s defence R&D spending (0.075% of GDP), with 85% allocated to DRDO, leaves limited room for private innovation. Additionally, the lack of dedicated UAV testing infrastructure, secure airspace, and a reliable domestic component ecosystem continues to impede indigenous long-endurance UAV development. (Rajiv, 2024)

The Role of Market Demand in Sustaining Private Sector UAV Development

In the drone manufacturing sector, the private industry operates primarily on a profit-driven model. To justify substantial investment in research, development, and production, companies require a consistent and high volume of orders. Robust demand from both domestic stakeholders—such as government agencies and private enterprises—and international markets is essential. Sufficient order volume not only enables economies of scale, thereby reducing per-unit costs, but also fosters sustainability and competitiveness. This economic viability is crucial for encouraging long-term private sector participation, continuous innovation, and the successful indigenisation of long-endurance UAV technologies in India. (B, 2025)

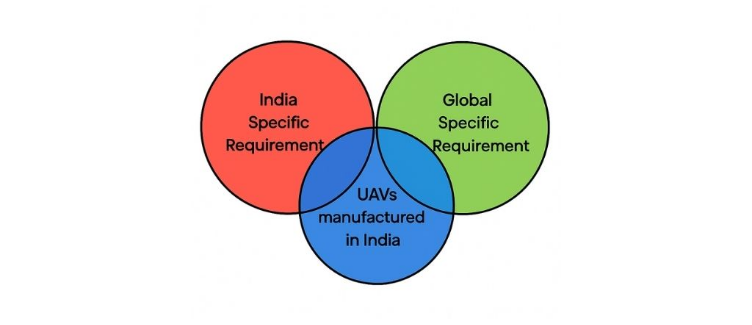

The ‘Indian Specific Requirement’ circle reflects domestic needs such as agriculture, surveillance, and disaster management. The ‘Global Specific Requirement’ includes diverse international regulations and performance standards. When ‘Drones made in India’ align with Indian needs, it shows local demand is being met; alignment with global needs indicates export readiness. The central intersection represents the ideal: drones manufactured in India that fulfil both domestic and international requirements-versatile, compliant, and competitive in global and national markets.

Recommendations

Reducing Dependence on Chinese Components

Addressing India’s reliance on Chinese UAV components necessitates targeted investment in domestic manufacturing, diversification of import sources, and robust policy support. Regulatory ambiguity and sluggish procurement processes currently hinder sustained private investment, undermining long-term self-reliance in critical UAV technologies.

Propulsion Innovation and Design Integration

Emerging propulsion trends—such as hybrid fuel-electric and all-electric systems—focus on high power-density motors and advanced batteries. These technologies are vital for improving endurance and efficiency and should be central to India’s UAV development roadmap. A shift toward an integrated design approach—merging aerodynamics, stealth, modularity, and secure ISR systems—is essential, supported by consistent investment and private-sector collaboration. (Jha, 2024)

Global Standards and Certification Infrastructure

To ensure export readiness and interoperability, Indian UAVs must meet international benchmarks like AS9100, DO-178C, and MIL-STD-810G. Compliance with such standards is critical, especially when targeting NATO and allied markets. Developing domestic certification bodies aligned with global regulators such as the FAA and EASA, along with incentives under schemes like the Production Linked Incentive (PLI) for drones, is imperative for improving private sector participation.

Enabling Policies: PPA and DPP

Two key policy frameworks—Priority Procurement Access (PPA) and Development-Production Partnership (DPP)—are pivotal for accelerating indigenous UAV capability. PPA prioritises procurement of domestic technologies from DRDO, defence start-ups, and private firms once operational requirements are met. This approach minimises procurement delays and reduces foreign dependence.

The DPP model bridges innovation and scalability by fostering early collaboration between R&D entities and production partners, including DPSUs and private manufacturers. This ensures manufacturability, cost-efficiency, and faster induction of critical systems. Together, PPA and DPP strengthen the Atmanirbhar Bharat initiative by aligning procurement efficiency with strategic autonomy. (Legal 500, 2024)

Potential of OMSA in UAV Development

The adoption of an Open Modular System Architecture (OMSA), modelled on the U.S. Department of Defence’s Modular Open Systems Approach (MOSA), offers significant potential for advancing indigenous long-endurance UAV development in India. By enabling modularity and standardised interfaces, OMSA allows private firms—particularly startups and SMEs—to focus on subsystems such as avionics, propulsion, AI-based navigation, EO/IR payloads, and communications without undertaking full-system development. This facilitates cross-disciplinary innovation, integration of commercial-off-the-shelf (COTS) technologies, and iterative upgrades aligned with operational demands.

OMSA also enables co-development with foreign OEMs under offset provisions, encouraging indigenous innovation while reducing dependency on complete technology transfers. For instance, firms like Godrej Aerospace and NewSpace Research & Technologies can concurrently develop modular components for HALE UAVs. However, challenges such as the absence of interface standards, limited interoperability, cybersecurity concerns, and unresolved intellectual property frameworks must be addressed. Institutionalising OMSA through DAP 2020, iDEX, and the Strategic Partnership Model, supported by national modular standards and collaborative R&D frameworks, is critical to its success.

Conclusion

India’s pursuit of long-endurance UAV self-reliance necessitates deeper private sector integration to overcome technological and supply chain dependencies. Strategic policy frameworks like DAP 2020 and iDEX provide a foundation, but must be reinforced with modular architecture adoption, streamlined procurement, and incentives for R&D investment. The institutionalisation of OMSA, modelled on the U.S. DoD’s MOSA, will enable subsystem specialisation, foster innovation, and reduce time-to-deployment. By aligning public resources with private agility, India can develop a robust, export-ready UAV ecosystem and enhance its operational preparedness across multi-domain theatres.

Disclaimer: The views and opinions expressed by the author do not necessarily reflect the views of the Government of India and Defence Research and Studies

Title image courtesy:

References

Gertler, J. (2012, January 3). U.S. Unmanned Aerial Systems (CRS Report R42136). Congressional Research Service. https://sgp.fas.org/crs/natsec/R42136.pdf (Accessed June 15,2025)

European Council on Foreign Relations. (2025). Drones in Ukraine: Four lessons for the West. https://ecfr.eu/article/drones-in-ukraine-four-lessons-for-the-west/ (Accessed June 15,2025)

Northrop Grumman. (n.d.). RQ-4 Global Hawk. Retrieved June 5, 2025, from https://www.northropgrumman.com/what-we-do/air/global-hawk (Accessed June 15,2025)

Center for Strategic and International Studies. (2025). The Russia-Ukraine Drone War: Innovation on the Frontlines and Beyond. https://www.csis.org/analysis/russia-ukraine-drone-war-innovation-frontlines-and-beyond (Accessed June 15,2025)

RAND Corporation. (2014). Emerging Trends in China’s Development of Unmanned Systems. https://www.rand.org/pubs/research_reports/RR990.html (Accessed June 18,2025)

what is a long endurance drone? (2025, April 16). Grepow Blog. https://www.grepow.com/blog/what-is-a-long-endurance-drone.html?hl=en-GB (Accessed June 15,2025)

Gp Capt. RK Narang. (2019). India’s Quest for UAVs and Challenges. (Accessed June 13,2025)

MQ-9A “Reaper.” (n.d.). General Atomics . Retrieved June 5, 2025, from https://www.ga-asi.com/remotely-piloted-aircraft/mq-9a (Accessed June 22,2025)

Chandra, T. (n.d.). DRDO-Industry-Academia Centre of Excellence. https://www.iitk.ac.in/new/index.php/drdo-industry-academia-centre-of-excellence

IIT Madras Centre of Excellence working with DRDO on Advanced Defence Technologies including Combat Vehicle Technologies | Indian Institute of Technology Madras. (n.d.). https://www.iitm.ac.in/happenings/press-releases-and-coverages/iit-madras-centre-excellence-working-drdo-advanced-defence

MP-IDSA. (2024, August 7). Defence Budget 2024–25: Key highlights – MP-IDSA. https://www.idsa.in/publisher/issuebrief/defence-budget-2024-25-key-highlights

Idex Details | DDP. (n.d.). https://www.ddpmod.gov.in/offerings/schemes-and-services/idex

Scooting tech barriers for Indian military drones. (n.d.). https://www.sps-aviation.com/features/?catId=1&h=Scooting-Tech-Barriers-for-Indian-Military-Drones&id=450&utm

Pubby, M. (2025, June 19). Defence ministry to overhaul procurement rules, aims for faster deals and stronger private sector role. The Economic Times. https://economictimes.indiatimes.com/news/defence/defence-ministry-to-overhaul-procurement-rules-aims-for-faster-deals-and-stronger-private-sector-role/articleshow/121960639.cms?utm_

Indigenisation OF UAVs BY INDIA AND ITs Challenge’s. (2017). In AIR POWER Journal (pp. 87–91). PDF (Bharadwaj, 2024)

Admin. (2024, April 18). Indian MOD’s HALE UAV program stalls as private sector seeks foreign collaboration. Indian Defence Research Wing. https://idrw.org/indian-mods-hale-uav-program-stalls-as-private-sector-seeks-foreign-collaboration/ (Accessed May 15,2025)

Goel, C. (2018). A Study of Major Issues Related to Brain Drain from India to USA [Research Article]. International Journal of Advance Research, Ideas and Innovations in Technology, 497–498. https://www.ijariit.com

Admin. (2025a, February 23). TASL seeks MOD approval to develop HALE UAVs for Indian Armed Forces. Indian Defence Research Wing. https://idrw.org/tasl-seeks-mod-approval-to-develop-hale-uavs-for-indian-armed-forces/(Accessed May 15,2025)

Indigenization and Self-Reliance in Defence Procurement: A Legal Analysis of the Defence Acquisition Procedure 2020 – Legal developments. (n.d.). The Legal 500. https://www.legal500.com/developments/thought-leadership/indigenization-and-self-reliance-in-defence-procurement-a-legal-analysis-of-the-defence-acquisition-procedure-2020/?utm

B, V. (2025, June 22). Tamil Nadu emerging as key contributor in manufacturing drones for the armed forces, and other electronic defence systems. The Times of India. https://timesofindia.indiatimes.com/city/chennai/tamil-nadu-emerging-as-key-contributor-in-manufacturing-drones-for-the-armed-forces-and-other-electronic-defence-systems/articleshow/122009497.cms?utm_

Admin. (2025b, April 2). Solar defence takes on the MALE UAV challenge, after DRDO’s MALE UAV struggles. Indian Defence Research Wing. https://idrw.org/solar-defence-takes-on-the-male-uav-challenge-after-drdos-male-uav-struggles/ (Accessed May 20,2025)

Admin. (2025c, April 19). Rise of India’s private defence sector: A talent drain for PSUs. Indian Defence Research Wing. https://idrw.org/rise-of-indias-private-defence-sector-a-talent-drain-for-psus/ (Accessed May 20,2025)

Discovery Alert. (2025, May 1). China’s Rare Earth Export Controls: Global supply chain risks. https://discoveryalert.com.au/news/chinas-rare-earth-export-strategy-global-supply-2025/ (Accessed June 23,2025)

Drones in India. (2014, December 7). Drones in India. Center for the Study of the Drone. https://dronecenter.bard.edu/drones-in-india/ (Accessed May 20,2025)

Express Defence. (2024, May 11). IdeaForge earns AS 9100D Certification: Elevating standards in drone technology. Financial Express. https://www.financialexpress.com/business/defence-ideaforge-earns-as-9100d-certification-elevating-standards-in-drone-technology-3484252/ (Accessed May 20,2025)

Geopolitechs. (2024, October 19). China’s new export control regulations: Products containing Chinese materials or using Chinese-origin technology can be subject to control. https://www.geopolitechs.org/p/chinas-new-export-control-regulations (Accessed June 23,2025)

George, S. (2025, June 11). India’s new warfare: Drones, data, and the defence race that can’t wait. The Economic Times. https://m.economictimes.com/news/defence/indias-new-warfare-drones-data-and-the-defence-race-that-cant-wait/articleshow/121758612.cms (Accessed May 20,2025)

Government of India, Ministry of Defence. (n.d.). Defence acquisition procedure 2020. https://icmai.in/icmai/Technical_Cell/docs/Annexures/67.pdf (Accessed June 14,2025)

Mai, J., & Mai, J. (2024, July 31). China imposes export controls on drones and parts with potential for military use. South China Morning Post. https://www.scmp.com/news/china/military/article/3272636/china-imposes-export-controls-drone-parts-military-and-civilian-use (Accessed June 23,2025)

N, M. V. T. (2025, February 25). Drone and drone components imports in India from China (2024). LinkedIn. https://www.linkedin.com/pulse/drone-components-imports-india-from-china-2024-murali-vinay-t-n–dsy6f (Accessed June 23,2025)

NH Digital, & Digital, N. (2025, May 28). China’s dominance overshadows India’s drone ambitions despite breakthroughs. National Herald. https://www.nationalheraldindia.com/national/chinas-dominance-casts-shadow-over-indias-drone-ambitions-despite-battlefield-breakthroughs (Accessed June 22,2025)

Posts, V. M. (2022, September 20). TAPAS/Rustom-II: India’s high-end military drone. Air Power Asia. https://airpowerasia.com/2022/09/20/tapas-rustom-ii-indias-high-end-miltary-drone/ (Accessed May 14,2025)

Raghav, D. (2025, April 4). Indian govt’s drones funding underutilised as makers opt for China-made flight controllers. Medianama. https://www.medianama.com/2025/04/223-indian-govt-drones-funding-underutilized-as-makers-opt-for-china-made-flight-controllers/ (Accessed June 23,2025)

Rkbhonsle. (2025, April 14). DRDO strategic success, conventional laggard. Security Risks Asia. https://www.security-risks.com/post/drdo-strategic-success-conventional-laggard(Accessed June 14,2025)

Rustom Unmanned Aerial Vehicle (UAV). (n.d.). Airforce Technology. https://www.airforce-technology.com/projects/rustom-uav/(Accessed May 19,2025)

Sharma, S. (2025, February 9). Army cancels Rs 230 crore drone contracts over alleged use of Chinese components. India Today. https://www.indiatoday.in/india/story/army-cancels-rs-230-crore-drone-contracts-over-alleged-use-of-chinese-components-2676137-2025-02-07 (Accessed June 25,2025)

Stutt, A. (2025, June 22). US-China deal, and more DoD money will not loosen China’s grip on military-grade rare earths magnets. MINING.COM. https://www.mining.com/us-china-deal-and-more-dod-money-will-not-loosen-chinas-grip-on-military-grade-rare-earths-magnets/(Accessed June 24,2025)

Bharadwaj, S. (2024, January 11). Navy receives first India-made MALE drone from Adani city co. The Times of India. http://timesofindia.indiatimes.com/articleshow/106722032.cms (Accessed May 17,2025)

Defence Research and Development Organisation. (2025, July 4). LAKSHYA‑2 [Advanced pilotless target aircraft]. Retrieved July 6, 2025, from https://www.drdo.gov.in/drdo/lakshya-2 (Accessed June 5,2025)